- [email protected]

- +16466550683

Social Trading By Rexor Investments

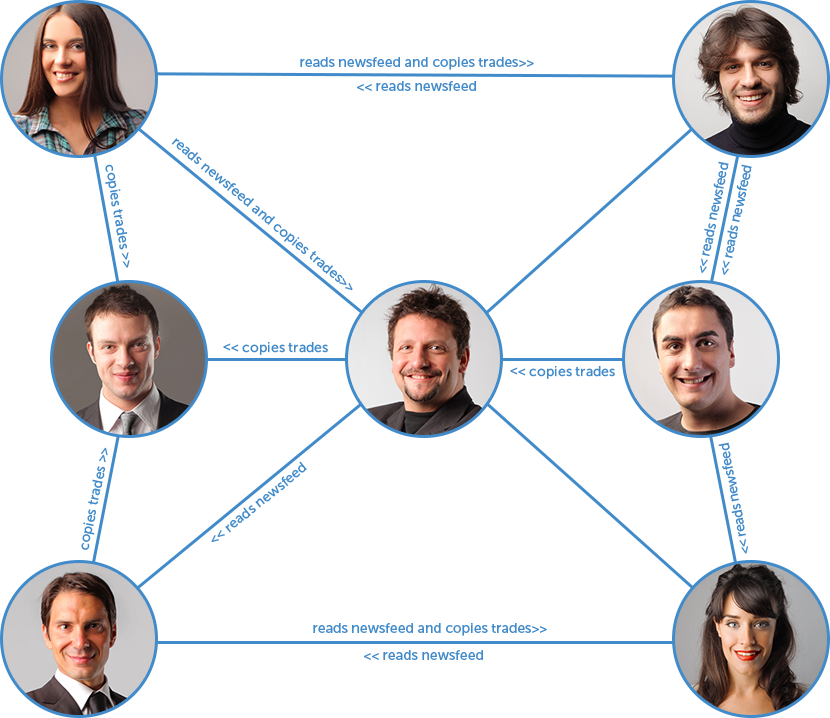

Automated social forex trading platform, ideal for copy traders to gain sucess in forex trading

Discover the world of successful trading by copying trades or become an example to follow!

The automated copy-trading system Soсial Trading will allow you to duplicate the best trades, trade independently, share information and communicate with your providers.

Take advantage of successful traders' experience or share your own success with others through our copy-trading system. Depending on your goals, choose the role that really suits you and achieve your objectives!

Synchronize your trades with successful providers' ones!

Get linked to a provider

You want to make money but don't have enough experience? Earn profits while copying trades and chatting.

Select

Find & select successful providers from our transparent and functional online monitoring.

Sign Up

Sign up as a copier and start copying trades of selected providers.

Start Earning

Learn, chat, and earn from copying experienced traders' trades onto your account.

OPEN MT4 ACCOUNT FIRST

OPEN COPIER ACCOUNT

Or

Become A provider

Are you an experienced and successful trader? Make profitable trades, attract copiers, and earn an extra income.

Sign Up

Open provider's account and pre-set profit sharing (%) of your copiers.

Trade

Trade profitably, update your personal newsfeed, and get a better ranking to attract more copiers.

Start Earning

Make your own trading profits and earn an extra commission from your copiers' accounts.

OPEN MT4 ACCOUNT FIRST

OPEN PROVIDER ACCOUNT

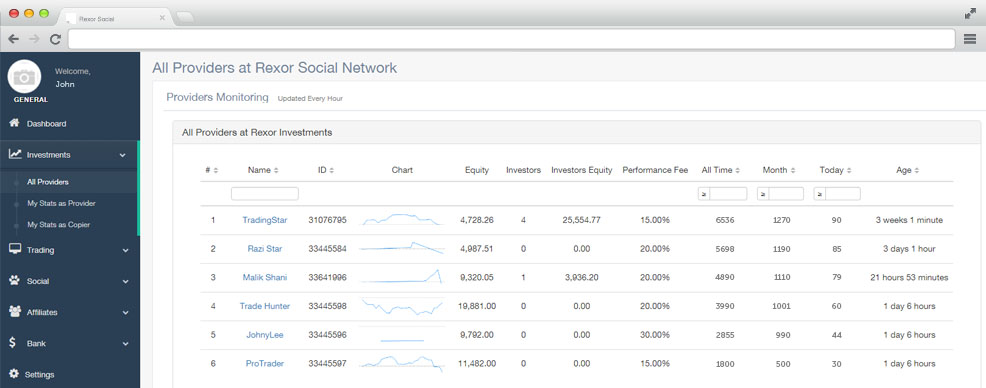

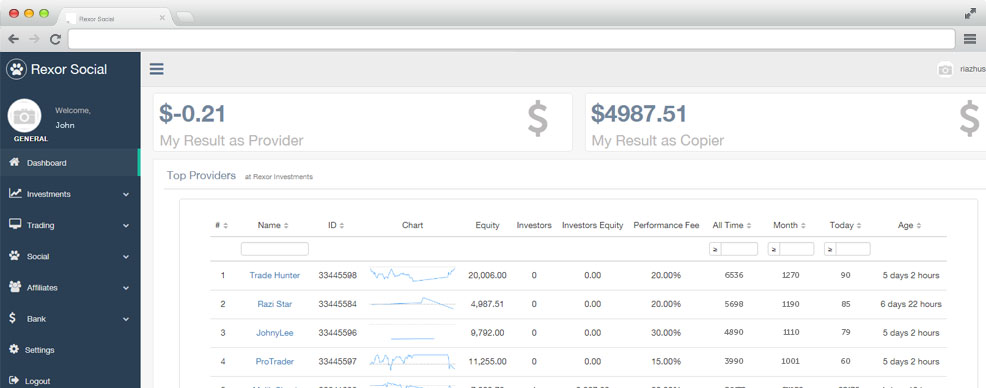

Monitoring of Providers

Top Providers at Rexor Investments

Monitoring of Providers

All Providers at Rexor Investments

Soсial Trading is a trading platform meant for success!

The copy-trading system means a high income and confidence in trading decisions every day.

| How Social Trading Works? | Who is Provider? | Who is Copier? | 4 Copy Types |

Who is Provider?

Are you an experienced and successful trader?

Become Provider Communicate and Trade Get Additional Income

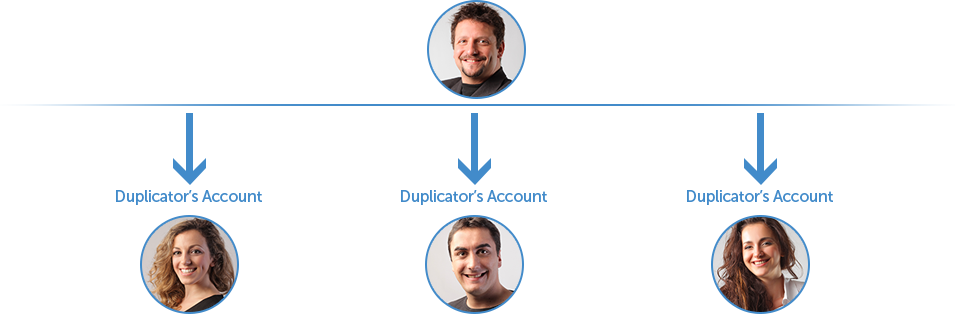

Providers make trades in their accounts and provide a newsfeed where they share trading successes and chat with their followers. Besides their own trading profits, providers also receive a commission from their copiers' accounts.

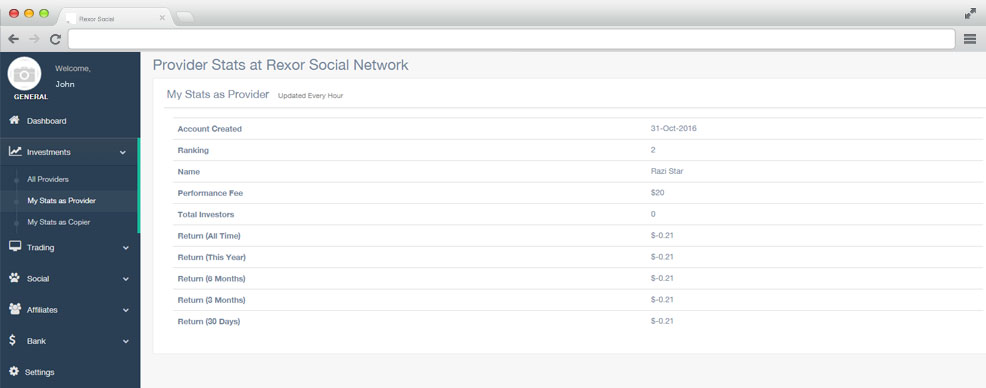

- 1:- You may open as many provider's accounts as you wish to fit each of your trading strategies. Pre-set profit sharing (%) of your copiers.

- 2:- Trade and improve your ranking among other providers to attract more followers and copiers.

- 3:- Share your trading successes and strategies in your newsfeed and attract new followers and copiers.

- 4:- Make your own trading profits and earn extra commission on top!

Who is Copier?

You want to make money but don't have enough experience?

Become Copier and Follower Copy Trades and Chat Earn Profit

Copiers copy providers' trades, make profits from them and pay providers a % of the profit. The amount of commission preset by a provider as a copy trading fee is displayed in our monitoring.

A follower is any client registered in the system and subscribed for a Provider's newsfeed.

- 1:- Select successful providers from our ranking using advanced filters, subscribe to their newsfeeds and choose an option to copy trades.

- 2:- Sign up as a copier and start copying trades of selected providers.

- 3:- Copy trades using any of the 5 methods we provide:

- - Autoscale Equity (Copying in proportion to Provider and Copier's equity)

- - Autoscale Free Margin (Copying proportionally to Free Margins of Provider and Copier(s) accounts)

- - Full (Full size copying 1 for 1)

- - Fixed (Copying a fixed size of each trade)

-

- 4:- Chat with providers live and follow their newsfeeds.

- 5:- Learn, trade and copy successful providers' trades.

- 6:- Earn from copying trades of experienced traders.

Copy Types?

1:- Full (Full Size Copying 1 for 1)

This Copy Type implies that the volume of a trade copied onto the copier's Account is equal to the volume of the respective trade in the Provider's Account. For example, if the Provider opens 5 lots, the copier’s account will open 5 lots as well.

2:- Fixed (Copying a Fixed Size of Each Trade)

This copy type implies that the volume of a trade copied onto the copier's account is always identical to the volume pre-set in copy settings. For example, if the copier sets a "copy fixed size" of 2 lots and the provider opens 5 lots, 2 lots will be opened on the copier's account.

4:- Auto-Scale Equity (Copying in Proportion to copier's Equity)

This copy type implies that the volume of a trade copied onto the copier's account is defined by the copier equity/provider's equity ratio. The volume of the copier's quity used for copying trades is defined in copy settings.

5:- Auto-Scale Free Margin (Copying proportionally to Free Margins of Provider and Copier(s) accounts)

This copy type implies that the volume of a trade copied onto the copier's account is defined by the copier free margin /provider's free margin ratio.

Frequently Asked Questions

1:- FAQ for Providers

Who pays the Company for the service?Profitability is computed using the following formula:

P=((E_end_1/E_begin_1)*(E_end_2/E_begin_2)*...*(E_end_N/E_begin_N)-1)*100%

where

P means "profitability in %"

E_begin_X means "funds available at the beginning of the period X".

E_end_X means "funds available at the end of the period X".

N means "the latest settlement period"

A rollover or any other balance operation marks the end of a previous period and the start of a new one, and we therefore recommend that a provider should perform a rollover if he/she needs to separate one trading session from another. The formula defines profitability in % from the the moment of registering an account.

A provider's profitability depends only on the results of his/her trading operations. Deposits and withdrawals have no influence on account profitability rates. This has to be taken into consideration when an account balance changes due to balance operations. Here's an example.

Lets assume a deposit of $500 is made into a provider's account. Some time later, the deposit becomes reduced to $100 following unsuccessful transactions, which is 80% less. This is displayed in the ranking.

To return the profitability rate to a break-even level, the provider needs to increase the capital fivefold (from $100 to $500) by showing positive performance.

The provider decides to top up the account to exit the drawdown in a more comfortable way and pays $50. The aggregate deposit becomes equal to $150. However, the account profitability remains unchanged at -80%.

Let's assume then that the account deposit becomes equal to the initial one, $500, as a result of profitable transactions carried out in the account.

Profitability = ((100/500*500/150)-1)*100 = 33.33%

Note that this fivefold deposit increase didn't make the account exit the drawdown: since the provider has made the additional deposit of $50, the aggregate amount of $150 was to have been increased fivefold. It means that in order to exit the drawdown, the provider needs to increase the account deposit to $750, i.e. a trading profit of $250 is still required for exiting the drawdown.

Profitability = ((100/500*750/150)-1)*100 = 0%

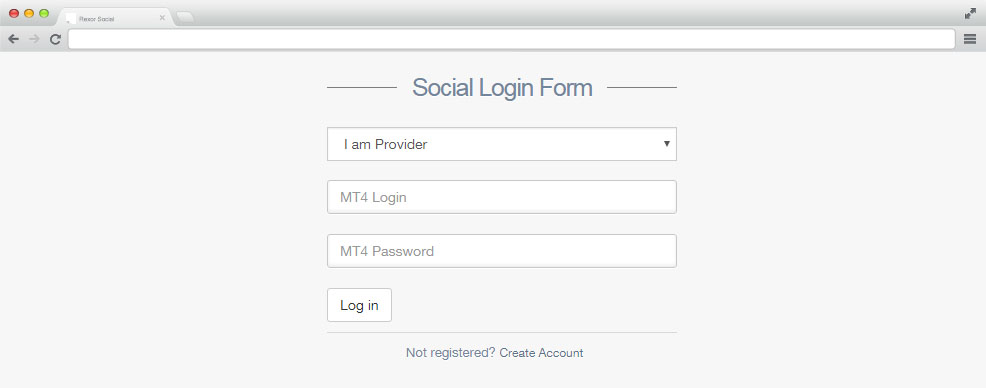

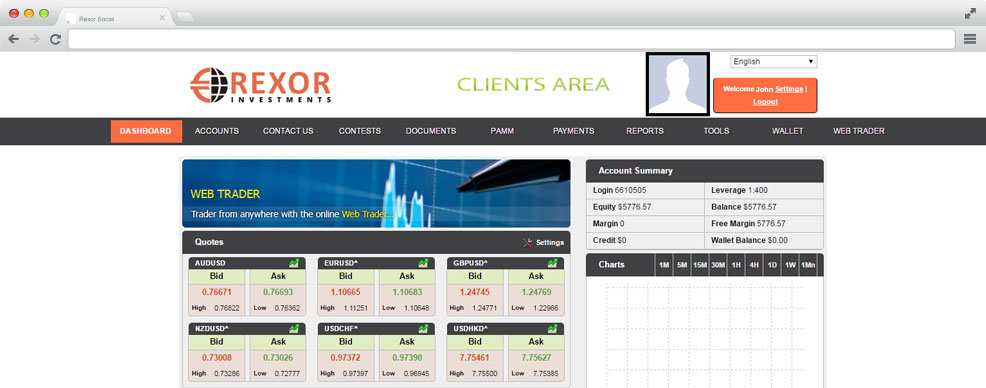

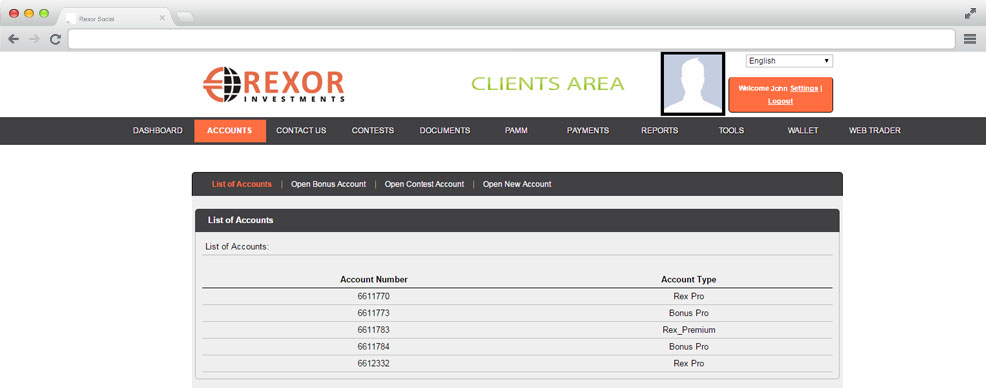

- Sign in to the Social Trading platform using your login (email address) and password from the Client Profile at Rexor Investments. Set you nickname when launching the platform for the first time. In case you don't have a profile with the Rexor Investments, register it here.

- Once the registration process completed, move to the "My profile" section and click on the blue button Open Provider's account. You can either create a new account or make one of your existing ECN accounts into Provider's account and then top it up. Please note: only accounts with a positive equity value may become provider's accounts.

- Determine your account settings: preset your provider's share and tick other fields based on your preferences, if necessary.

A rollover is a procedure of settling accounts between a provider and his/her copiers. A rollover means that a trading period has been completed and a new trading interval begins. If profits have been registered at the end of a trading period, the provider receives his pre-set share in copier's profits. Conversely, a rollover is not performed if no profits have been registered. Only copied trades are considered for a rollover.

To perform a rollover, a provider shall click on the button of the same name in the settings of his provider account. A withdrawal of funds from a provider's account does not initiate a rollover.

Each time a copier detaches his/her account from the provider or withdraws money from his/her account, a rollover is performed automatically on the copier's account. A rollover does not close any trades. This procedure is meant for settling accounts between a provider and a copier regarding profits made from closed trades, in the amount of a profit percentage pre-defined by the provider. Please note that insufficient equity in a copier’s account during a rollover may result in indebtedness (refer to p.2.5).

We advise providers to perform a rollover if there's a need to separate trading sessions, as the profitability formula considers an equity value after every balance operation.

Yes, he/she may. However, the change will apply only to new copiers who have joined the account after the change was made. All current copiers will still work under the conditions valid at the moment of their attachment.

Liquidation of a provider's account means that this account is no longer used as a provider's account and all copiers' accounts are detached from it. Liquidation of a provider's account is obligatorily preceded by a rollover. To initiate liquidation, a provider shall click on the red button "Delete provider's account" in the account settings.

Please note that liquidation does not consist in deleting an account as such but in cancelling the account's registration in the "Social trading" service. One and the same account may be registered as a provider's one and liquidated many times.

Open trades will be closed at the price valid at the moment of deleting the account.

There are none as trading in provider's account is not different from trading in a conventional ECN account.

Yes, you may suspend copy-trading on all or particular accounts attached to your account. Suspension means that new trades won't be copied. The trades already copied will be closed gradually as the respective trades are closed in provider's account.

No, you may not. Provider's account shall belong to another person.

Let's have a look at below example.

Let's assume a provider has increased his/her equity through trading from $500 to $550, registering 10% profitability. The provider has opened new trades and decided to withdraw the profit of $50. The aggregate equity amount becomes equal to $500 and the profitability remains at 10%.

The new trades turned out to be loss-making and the account equity dropped to $450. One would think the profitability should equal 0%, but, as you may have noted, the account equity dropped 10.1%, not 10%, following the opening of the new trades.

((550/500*450/500)-1)*100%=-1%

As a result, the ranking shows the profitability at -1%. The more equity changes due to balance operations, the more profitability will change in the ranking after another balance operation.

To prevent such situations, we recommend that you shouldn't execute needless balance operations. Instead, try to top up the account or make withdrawals after finishing a trading session and closing trades.

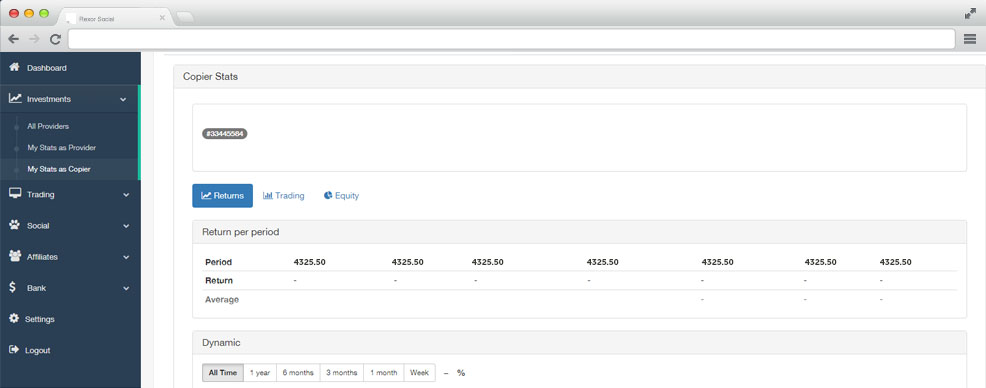

2:- FAQ for Copier

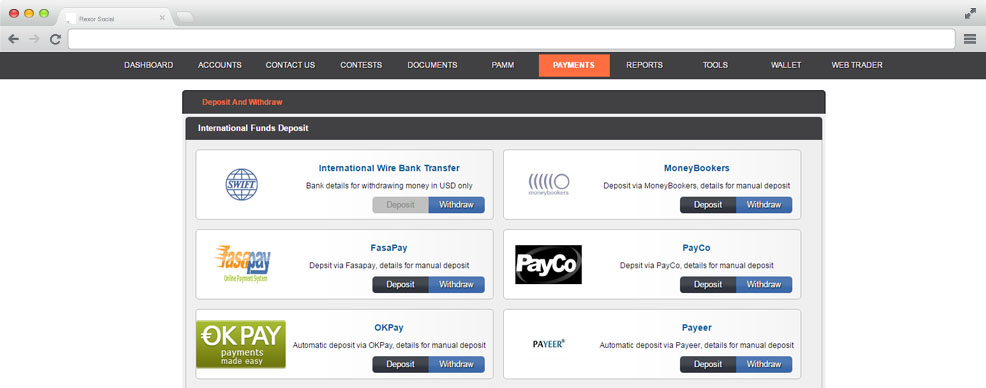

How do I register a copier's account?- Sign in to the Social Trading platform using your login (email address) and password from the Client Profile at Rexor Investments. Set you nickname when launching the platform for the first time. In case you don't have a profile with the Rexor Investments, register it here.

- Once you've signed in to the platform, click on the green button Open copier's account. You can either create a new account or make one of your existing ECN accounts into copier's account.

- Set parameters for your account: choose a provider's account from our ranking; then select one of the 4 copy types; next, set the equity level at which copying of new trades shall be suspended on copier's account, in the account currency. For more details on copy settings and stop level, please refer to items 2.3 and 2.5.

Social Trading platform offers 4 types of copying trades. The copier selects the type and sets the copying settings when attaching their account to the account of the provider. The copier should carefully approach the issue of selecting the copying type, estimate their funds and trading strategy of the provider's account from which they plan to copy the trades.

If the size of your funds differs significantly from the resources available on the provider's account, or you don't have enough experience to evaluate his/her strategy, in order to minimize trading risks use "Copying a fixed share of copier's equity"

For more details and illustrations, please refer to the section "Four copy types" on the page "How Social Trading works".

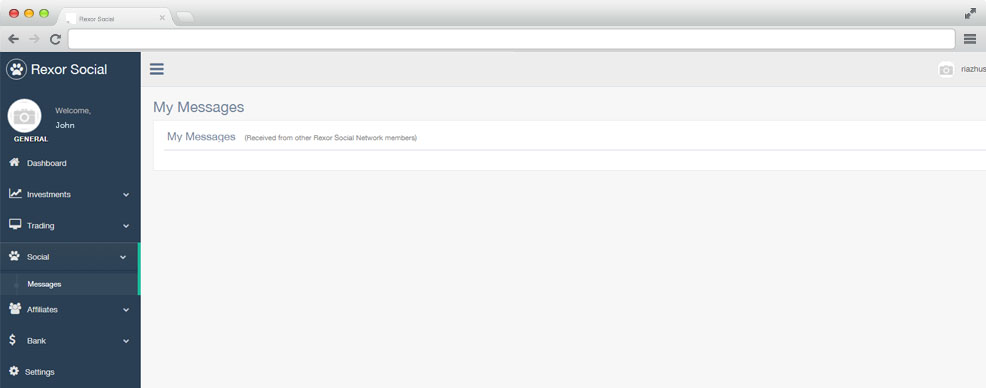

Also, we would advise you to get acquainted with a provider's account description before you choose your copy type and set your parameters. If there isn't any, you can always ask your provider directly via our social networking platform by writing them a private message or through their newsfeed.

Withdrawing funds from copier's account automatically launches rollover. At the same time, the provider's commission will be deducted from the money to be withdrawn. The following formula is applied:

Available funds = Equity-Credit - Margin-Commission,

Where commission means a payment for closed copied trades currently due to the provider (i.e. prospective commission that would be deducted from the account if rollover was performed).

For the information on when the debt emerged and how big it is refer to our special table. Debts can be paid off by transferring money from a client's another trading account or through any payment system. Please note that several debts shall be paid off in the order of appearance. Repayment of one debt does not cancel the rest of debts.

The copier’s account equity is checked and compared with the copy stop level every 2 (two) minutes.

Also, you can limit your risks by choosing a specific copy type, for example, copying a predefined % of provider's each trade or copying a fixed share of copier’s equity. Having preset a small percentage of copied trade volumes or using a fixed share of your equity, you can control your risks, but you reduce your prospective profits respectively as well.

- provider's pause;

- copier's pause;

- automatically, upon reaching a copy stop level;

- debt appearance.

Both providers and copiers may initiate the pause mode. The pause mode does not entail trades closure on a copier's account and does not limit trading risks in open trades. It only serves to pause a copying of new trades.

As for copy type and its settings, they may be changed only when there are no open trades in the account.

But remember, a copier's each account may be attached only to one of the provider's accounts.

No, they don't. A provider gets a commission only for those trades that have been copied from his/her account. The trades opened by a copier independently are not considered when performing Rollover.

- Volume of the trade to be copied is lower than minimum trade volume preset for the copier's account. - The copier's account does not have enough funds to open a new position. - The "Pause" mode has been enabled on the copier's account; - The "Pause" mode has been enabled on the provider's account to which the copier's account is attached. - The service has been disabled for a copier or a provider because of indebtedness, for example. - The copier's account equity is equal to or less than the value specified as Equity Stop Copying Level.

1. The trades may have closed following a change in your account settings. When you change a copy type for your copier's account, all the trades are closed automatically. Also, note that a change in a stop copy level does not affect open trades in any way.

2. You have been using a copy type different from "Copying a fixed share of copier's equity" and the trades therefore have closed due to Stop Out even if the provider's account remained unaffected.

3. If you have been using a copy type "Copying a fixed share of copier's equity", refer to item 2.17.

4. Make sure you haven't modified trades copied from the provider's account, set pending orders or opened your own trades. Such an interference with the provider's trading strategy may have caused a change in your account margin level regardless of the provider's account, and Stop Out therefore took place.

Otherwise, the volumes of copied trades can't be calculated correctly, which may result in Margin Call or Stop Out on the copier's account, even if the provider's account margin level suffices to keep positions open. We strictly recommend that the copiers opting for this copy type remain in contact with their providers to agree on a copy start time.

Providers are advised to inform their followers though the Social Trading feed about the best time to start copy trading, as well as about new deposits made in the provider's account. This will allow copiers to correct their account equities in time.

So, we can single out the following reasons for early closure of trades when using a copy type "Copying a fixed share of copier's equity":

1. Divergence of opening/closing prices in the provider's and copier's accounts. Even if the server copies an order within a few seconds, the price can still change.

2. The provider had open trades on his/her account by the time a copier joined him/her, which led to a disproportionate change in the provider's and copier's equities.

3. The copier's independent trading in the copy trading account, which doesn't allow calculating correctly equity ratios when copying trades.

4. The provider's account has been topped up without copier's accounts having been topped up, which has distorted the equity ratios in the accounts.